The Main Principles Of Federated Funding Partners Reviews

Table of ContentsThe Best Strategy To Use For Federated Funding PartnersExamine This Report about Federated Funding Partners BbbNot known Incorrect Statements About Federated Funding Partners The smart Trick of Federated Funding Partners That Nobody is DiscussingUnknown Facts About Federated Funding Partners Bbb

Also if you can't defeat your existing interest rate by consolidating debt with a personal financing, there might be a benefit: with a personal finance, you'll require to make a fixed month-to-month settlement that will certainly have your loan paid off by the end of the term (normally three or five years).You do not have access to 0% APR credit score card offers A reduced price is always great, however no passion at all is better. The secret, of program, is having a strategy to pay off debt.

Recap Personal loans benefit people with moderate (but not extreme) debt tons and also a good credit report who are seeking to simplify (or accelerate) their financial obligation settlement. Individual financings will certainly not resolve costs troubles, nonetheless, and also they should not be sought unless the debtor has already made serious steps towards reducing their costs as well as living within their methods.

When you want to borrow money to manage your economic demands, you will certainly find on your own faced with various alternatives. While there's frequently no doubt of whether an automobile funding, trainee lending or home mortgage is the appropriate sort of finance for you, there are some kinds of finances that aren't so cut and completely dry.

Not known Factual Statements About Federated Funding Partners

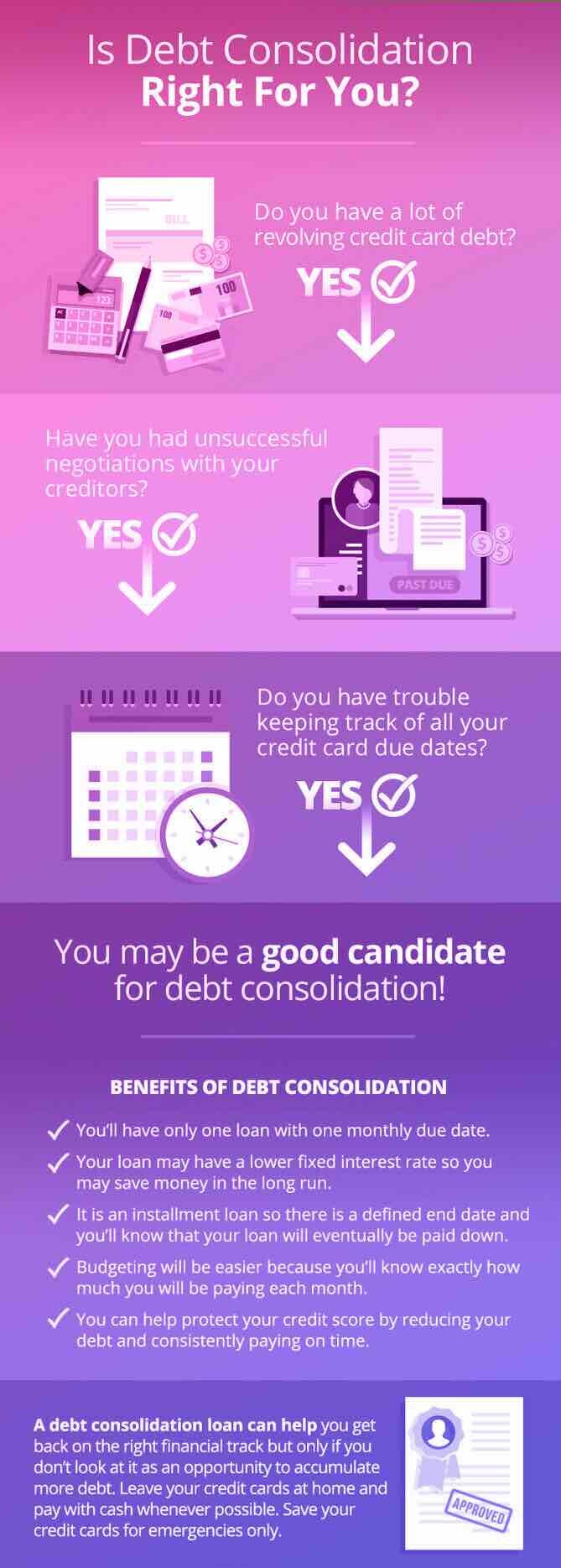

While individual loans can be made use of for a variety of reasons when you need additional cash money, such as funding a trip or buying a brand-new couch, if you need to consolidate your financial obligation, a financial obligation combination loan is the very best course to take. Why Take Into Consideration Financial Obligation Loan Consolidation? With a lot of costs to pay monthly, it's very easy to allow one slip by, and when that takes place, you're hit with a late charge or an enhanced rate of interest.

Debt combination suggests that you are paying off all or a few of your financial debt with one brand-new car loan (federated funding partners reviews). That way, rather than making 5 payments every month to various companies to repay your financial obligation, you make only one settlement each month, to only one financial institution. To get a financial debt loan consolidation funding, loan providers wish to know that you can afford to make the payments.

Nonetheless, unlike at various other financial institutions and also credit scores unions, financial obligation consolidation car loans at San Francisco Federal Cooperative credit union are unsecured, meaning there's no requirement for collateral. If you are thinking of a financial obligation consolidation financing, your rate of interest, the length of the loan, and also linked costs are one of the most essential terms to take into consideration.

Begin by comparing your present passion prices to the passion prices supplied for the financing. If you can, obtain a funding with a reduced rate of interest rate, which will certainly enable you to conserve cash over the size of your financing.

The Buzz on Federated Funding Partners

Pay much less in interest Another dig this primary benefit of settling your financial obligation is that, often times, you can protect a brand-new funding with a reduced rate of interest. If you're paying less in interest for your debt, you could perhaps save hundreds or thousands of bucks over your finance term contrasted to if you didn't consolidate.

Debt loan consolidation fundings are especially created to aid you pay off a round figure of financial obligation, whereas individual fundings are for when you require money for a variety of reasons. If you're thinking about debt combination, you wish to be certain that it's the best option which you choose the most effective finance for your economic scenario. federated funding partners reviews.

Choose an individual funding just if you have money flow requirements. This isn't an action that ought to be taken gently, so take your time doing the needed study before making a decision.

How Federated Funding Partners Legit can Save You Time, Stress, and Money.

The debt consolidation approach you choose depends on your individual situation and also what jobs best for your financial resources as well as the amount of financial obligation you have. Well, it all depends on the type of financial obligation you have.

Right here are some of the alternative selections that can help stabilize your scenario as well as ultimately eliminate your financial debt. Equilibrium Your Spending plan One of the most efficient option to consolidating financial obligation is learning to survive much less than what you make. In other words, make a budget and also stick to it. Make the effort to list income and also costs, after that readjust those numbers until the column under revenue surpasses expenditures.

Federated Funding Partners Reviews Fundamentals Explained

Do-It-Yourself (DIY) Financial Obligation Administration Plan Credit scores therapists function with debt card firms to reduced passion prices. You can attempt doing to the very same for on your own.